Election Blues: Looking at Election History for Market Guidance

As has often been the case, an “October surprise” came with a jolt early Friday with the announcement of President Trump’s positive COVID-19 test result.

Political pundits have been out in full force; with some consensus on the consequences of the diagnoses with regard to the election and fiscal stimulus.

A look at history is essential to understand that the relationship between politics and the stock market is varied and without consistent messages.

For investors wondering what to do now: we would caution against trying to make short-term bets on the lead-in to the election, especially with regard to its possible outcome. History supports the view that betting on election outcomes is a risky strategy.

It was always my intention to write about the upcoming election, what history says about its impact on the stock market (or vice versa), and dos and don’ts for investors. What I didn’t expect was waking up at 2am on Friday morning (which is normal for me—I’m a chronic middle-of-the-night insomniac) to the news of President Trump and the First Lady contracting COVID-19.

The term “October surprise” dates back to Ronald Reagan’s 1980 campaign associated with the Iranian hostage crisis; but there has been a long history of notable news events late in election seasons, including:

- Gore vs. Bush contested election in 2000

- Indictment of Reagan’s Defense Secretary Weinberger associated with Iran-Contra in 1992

- Nixon’s Secretary of State Kissinger declaring he believed “peace is at hand” re: Vietnam War in 1972

- Lyndon Johnson halting U.S. bombing of North Vietnam in 1968

- Israel’s invasion of Egypt in 1956

- Assassination attempt on Teddy Roosevelt in 1912

- Hamilton’s denunciation of Adams in 1800

What we all know with little doubt is that this year has been unprecedented in ways most of us couldn’t fathom before 2020 began. I look at the history of election years and commensurate market/economic performance in this report. But perhaps it’s with a larger grain of salt we should take those messages given a global pandemic, a recession via a government mandated economic shutdown, heightened social unrest, and now the president’s diagnosis news.

Keep an eye on upcoming reports from my colleague Mike Townsend on all things election-related; as well as his Twitter feed: @MikeTownsendCS. In addition, to the extent market volatility remains elevated and/or election-related news hits the stock market to a significant degree, we will continue to post volatility-related communications on Schwab.com.

Consensus of the political punditry

If we thought 2020 couldn’t add more uncertainties to the mix, we were reminded again late-last week that we’re still in the throes of it. I am not a political pundit; but I do listen to/read what they’re thinking (especially the non-partisan pundits). They were out in full force Friday morning and throughout the weekend. It appears the general consensus at this early stage of the post-POTUS-diagnosis phase of election season can be broken down as follows:

- It increases the odds of a Democratic sweep; although a swift recovery by the president might reverse some of that sentiment.

- The upcoming vice presidential debate—surprisingly being held in person—will receive even more attention.

- The tradition of heavy campaigning in the final stretch to the election will be curtailed even more than before; and there will be much focus on how the president will communicate during his quarantine/treatment (keep an eye on his Twitter feed).

- The next presidential debate—scheduled for October 15—is uncertain, although there is little-to-no chance it will be an in-person town hall-style debate, as was originally planned.

- There is likely to be heightened focus by both parties on getting another fiscal relief package passed in Congress (especially given weaker job growth announced on Friday).

Now on to broader themes/risks

The two election outcomes most cited—and certainly asked about in the many virtual client events I’ve been doing— are the policy implications of a sweep by the Democrats and a contested election that extends uncertainty well past November 3. Before I get to the analysis of those outcomes, a “public service announcement” (PSA) is in order: Many investors who ask questions about the election and its market impact seem to be looking for easy answers; or a clear and consistent relationship between variable X (in this case the election) and market performance. That does not happen with consistency when comparing economic variables, sentiment conditions, earnings growth rates, valuations, etc. to market performance … and it certainly doesn’t happen with politics and the market.

In terms of the two outcomes noted above, the first—a Democratic sweep—is a risk in that it represents possible significant policy changes around taxes, regulation, health care and foreign policy (among others). Although risk of regulatory changes is real (especially with regard to the climate)—given the authority of the president in such matters—clients seem to be most concerned about tax policy. Schwab’s Center for Financial Research recently published a report comparing the candidates’ tax plans and implications/strategies for investors.

Remember, even with a Democratic sweep, if the Senate majority is only slightly in favor of the Democrats, the filibuster rule may prevent meaningful change to tax policy. In fact, at this stage, the Senate race is close to a toss-up based on recent polls/analysis. In terms of the filibuster, Democrats may vote to eliminate it; but there is a lack of unanimity among Democrats for the collection of tax proposals, while many of the tax proposals don’t affect the majority of taxpayers (at least not directly).

The second is a risk in terms of possible contested election-related volatility. Some of the more extreme concerns may be overstated given that our democratic process and the electoral system was designed to “enforce” a peaceful and timely transfer of presidential power. Most political analysts believe the identity of the next president will likely be named no later than December 8; which is the “safe harbor” deadline for states to appoint electors without interference by Congress. If that deadline passes without a victor, additional bodies will take over the process—including the Supreme Court, Congress (which officially counts the ballots of the electors on January 6), and the governors of states with contested ballot counts.

Importantly, there are important policy issues that likely won’t be altered much regardless of the election outcome; including the Federal Reserve’s monetary policy and anti-trust focus on U.S. technology giants, about which there is bipartisan support. There is also bipartisan support for more fiscal stimulus—notwithstanding the differences between the parties’ priorities specific to the current negotiations.

Market behavior

We have already seen uncertainty regarding the election’s impact on the stock market—particularly with regard to volatility. When stocks were hitting all-time highs in early-September, the volatility index (VIX) was also ramping; which is not typically the pattern. What was different then was that the October (and more recently the November) VIX contract prices were elevated due to election-related uncertainty; so the September VIX contract was converging to the higher level of the forward contracts.

We have also seen swings in sector performance driven by polling and virus-related data; and that’s likely to continue into the election. However, we would caution against trying to make short-term bets on the lead-in to the election, especially with regard to its possible outcome. History supports the view that betting on election outcomes is a risky strategy.

Looking back

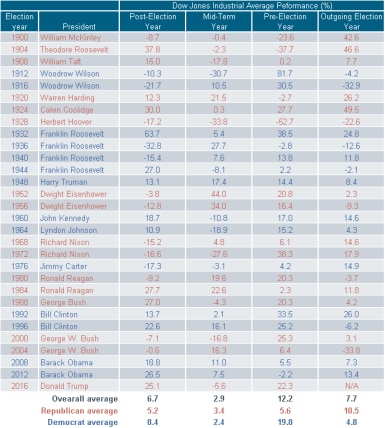

We use the Dow Jones Industrial Average (Dow) as the proxy for U.S. stocks in the analyses below because of its longer history than the S&P 500, which wasn’t created until the late-1920s. Likely highlighted more by Democrats than Republicans is the fact that, since 1900, the stock market has performed better when Democrats sit in the White House than when its inhabitant was a Republican.

As you can see in the first two bars in the chart below, if an investor had invested $10,000 starting in 1900, but only had it in the Dow when Republicans were president, it would now be worth nearly $99k. On the other hand, that same $10,000 would have grown to nearly $430k if it was invested only when Democrats were president. Seems like an obvious decision to make then? Not so fast. That same $10,000 in 1900 would have grown to more than $4.2 million if the investor had remained in the market the entire time, regardless of which party has presidential power.

Staying Invested vs. Investing in Single Party

Source: Charles Schwab, Bloomberg, as of 10/2/2020. For illustrative purposes only. The above chart shows what a hypothetical portfolio value would be if a hypothetical investor invested $10,000 in a portfolio that tracks the Dow Jones Industrial Average on 1/1/1900 under three different scenarios: a Republican presidential administration; a Democratic presidential administration; or staying invested in the market throughout the entire period noted. Chart does not reflect effects of fees, expenses or taxes.

For those who want to geek out with more detailed data on the history of presidents/parties controlling the White House, the table below shows every president since 1900—color-coded by their party affiliation—and the Dow’s performance during all four years of each election cycle. Don’t just look at the averages at the bottom though; look at the range of outcomes. Assuming you know your history, it’s clear that there have been myriad significant impacts on market performance that had little-to-no relationship to the party in the White House (some examples include WWII, the Crash of ’87, 9/11 and the Global Financial Crisis).

Source: Charles Schwab, Bloomberg, S&P Dow Jones Indices, as of 12/31/2019. For illustrative purposes only.

We’ve often said that the economy impacts elections more than elections impact the economy. The table below looks at every election year since 1900 and whether there was a 20% stock market decline and/or an economic recession (yellow for yes, green for no). There were 14 election years during which there was a bear market and/or a recession. In nine of those cases, the incumbent president lost the race, while a lesser five were won by the incumbent. All six election years since 1952 that were accompanied by a bear market and/or a recession saw the incumbent lose. More stark is what’s happened during healthier economic/market times during elections. Of the 16 election years when there was neither a bear market nor a recession, the incumbent won 13 times, while only losing three times.

Source: Charles Schwab, ©Copyright 2020 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/. 20% market decline based on Dow Jones Industrial Average. For illustrative purposes only. Past performance is no guarantee of future results.

Congress matters as well

Of course, this is not just an election for president; but also for many members of Congress. The table below shows the history of party control over the presidency and Congress—covering all six possible outcomes. For what it’s worth, the best performance historically has come when there was a Democrat in the White House and a split in Congress. Caveat: notice that this has only been the case 3.4% of the time since 1900—in fact, it was solely the four years when President Obama was in the White House and Congress was divided, between January 2011 and January 2015.

Source: Charles Schwab, ©Copyright 2020 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/. As of 3/4/1901-10/2/2020. Past performance is no guarantee or indications of future results.

As seen above, in terms of the two most-common combinations—full Democratic control (33.4% of the time) and full Republican control (23.5% of the time)—there were nearly identical annualized returns.

What really matters

Last year, political historian and journalist Michael Barone wrote the book How America’s Political Parties Change (and How They Don’t) in which he “politely asks the prognosticators to take it easy.” As Barone highlights in the book, the current environment may not be as extreme in its differences relative to history as some believe. After every significant national crisis in America, our government has emerged with sometimes-greater, but always new and different roles. Caveat: Any historical analysis is not a blueprint for the future (much like the oft-published footnote that “past performance is no guarantee of future results”).

Major policy changes often can rearrange traditional political divides. Case in point in the COVID-19 pandemic era would be the fact that Senate Republicans have voted for policies they’ve formerly opposed; like paid sick leave, a guaranteed minimum income (supplemental unemployment insurance), moratoriums for renters’ payments and student debt relief. At the same time, there appears to be bipartisan support for kicking the deficit/debt can down the road. Some are even suggesting that there is bipartisan support for modern monetary theory (MMT).

Barone wrote about the “long history—and striking resilience—of our two political parties. Both parties have changed their policies, adapting to economic and demographic circumstances and to signals in the political marketplace. The fact that they have been doing so, performing those functions under stress and despite some massive setbacks for so long provides some basis for thinking they will pass through the stress test being administered by [President] Trump, his Republican fans and critics, and his Democratic opponents, as they have passed through others even more stringent many times before. Perspective is a better guide to reality than panic.”

What you can do next

- Follow Liz Ann Sonders on Twitter: @lizannsonders.

- Explore other topics on Insights & Ideas.

- Talk to us about the services that are right for you. Call us at 800-355-2162, visit a branch, find a consultant or open an account online.